Top cryptocurrency

It also makes it harder to distinguish transaction participants on the public distributed ledger by combining single-signature and multi-signature transactions into a single verification process, thereby enhancing privacy betsoft gaming software.

Here at CoinMarketCap, we work very hard to ensure that all the relevant and up-to-date information about cryptocurrencies, coins and tokens can be located in one easily discoverable place. From the very first day, the goal was for the site to be the number one location online for crypto market data, and we work hard to empower our users with our unbiased and accurate information.

It may be possible to buy Bitcoin instantly on centralized exchanges, because an exchange account isn’t really a wallet. Instead, it is an electronic reflection of fund balances that an exchange will display, even though the actual funds have not moved – the user is simply entitled to a small amount of the BTC held by the exchange.

Cryptocurrency prices

With a blockchain, it’s possible for participants from across the world to verify and agree on the current state of the ledger. Blockchain was invented by Satoshi Nakamoto for the purposes of Bitcoin. Other developers have expanded upon Satoshi Nakamoto’s idea and created new types of blockchains – in fact, blockchains also have several uses outside of cryptocurrencies.

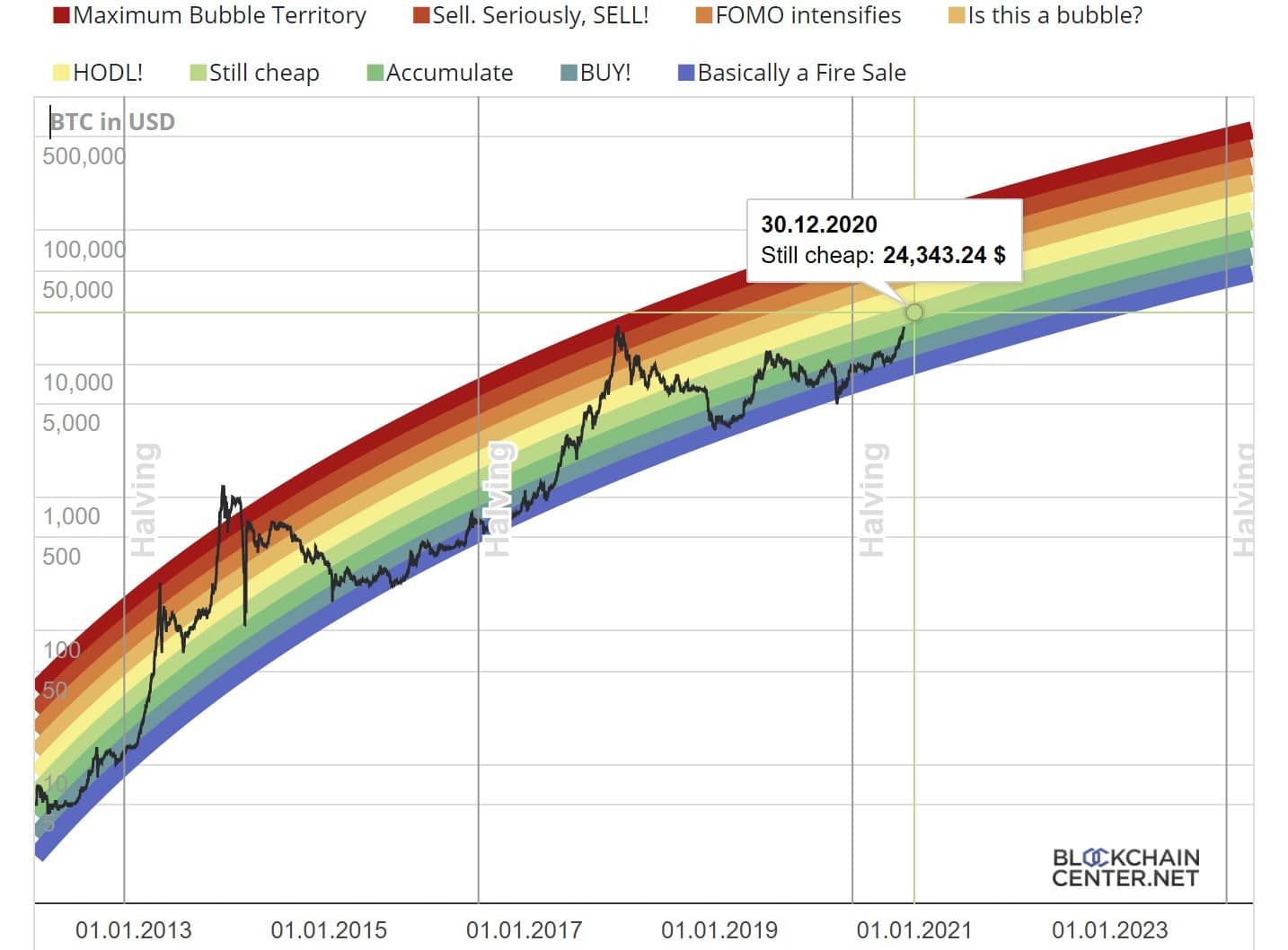

If you want to invest in cryptocurrency, you should first do your own research on the cryptocurrency market. There are multiple factors that could influence your decision, including how long you intend to hold cryptocurrency, your risk appetite, financial standing, etc. It’s worth noting that most cryptocurrency investors hold Bitcoin, even if they are also investing in other cryptocurrencies. The reason why most cryptocurrency investors hold some BTC is that Bitcoin enjoys the reputation of being the most secure, stable and decentralized cryptocurrency.

Cryptocurrencies are digital assets that are secured by cryptography. They use decentralized networks to transfer and store value, and the transactions are recorded in a publicly distributed ledger known as the blockchain. Transactions are verified by network nodes and recorded in a public distributed ledger known as the blockchain. Cryptocurrency transactions are secure, and are verified by a decentralized network of computers.

With a blockchain, it’s possible for participants from across the world to verify and agree on the current state of the ledger. Blockchain was invented by Satoshi Nakamoto for the purposes of Bitcoin. Other developers have expanded upon Satoshi Nakamoto’s idea and created new types of blockchains – in fact, blockchains also have several uses outside of cryptocurrencies.

If you want to invest in cryptocurrency, you should first do your own research on the cryptocurrency market. There are multiple factors that could influence your decision, including how long you intend to hold cryptocurrency, your risk appetite, financial standing, etc. It’s worth noting that most cryptocurrency investors hold Bitcoin, even if they are also investing in other cryptocurrencies. The reason why most cryptocurrency investors hold some BTC is that Bitcoin enjoys the reputation of being the most secure, stable and decentralized cryptocurrency.

Cryptocurrency market

The term DeFi (decentralized finance) is used to refer to a wide variety of decentralized applications that enable financial services such as lending, borrowing and trading. DeFi applications are built on top of blockchain platforms such as Ethereum and allow anyone to access these financial services simply by using their cryptocurrency wallets.

In January 2024 the SEC approved 11 exchange traded funds to invest in Bitcoin. There were already a number of Bitcoin ETFs available in other countries, but this change allowed them to be available to retail investors in the United States. This opens the way for a much wider range of investors to be able to add some exposure to cryptocurrency in their portfolios.

A stablecoin is a crypto asset that maintains a stable value regardless of market conditions. This is most commonly achieved by pegging the stablecoin to a specific fiat currency such as the US dollar. Stablecoins are useful because they can still be transacted on blockchain networks while avoiding the price volatility of “normal” cryptocurrencies such as Bitcoin and Ethereum. Outside of stablecoins, cryptocurrency prices can change rapidly, and it’s not uncommon to see the crypto market gain or lose more than 10% in a single day.